Many investors are closely monitoring the cryptocurrency market today as Bitcoin approaches an all-time high of $75,000, largely fueled by the anticipation surrounding Donald Trump’s potential return to the presidency. With the global market cap soaring to $2.47 trillion, other altcoins such as Ethereum and Dogecoin are also experiencing significant gains. In this post, you’ll discover the latest price updates and insights into how the US election results are impacting cryptocurrency valuations.

Cryptocurrency Price Overview on November 6

While Bitcoin surged on November 6, emerging as a frontrunner in the cryptocurrency market, its price neared the all-time high of $75,000, driven by heightened investor interest following the US election rally. With the overall market displaying optimism, altcoins like Ethereum and Dogecoin also recorded significant gains, reflecting a robust sentiment across the crypto space.

Global Market Capitalization Trends

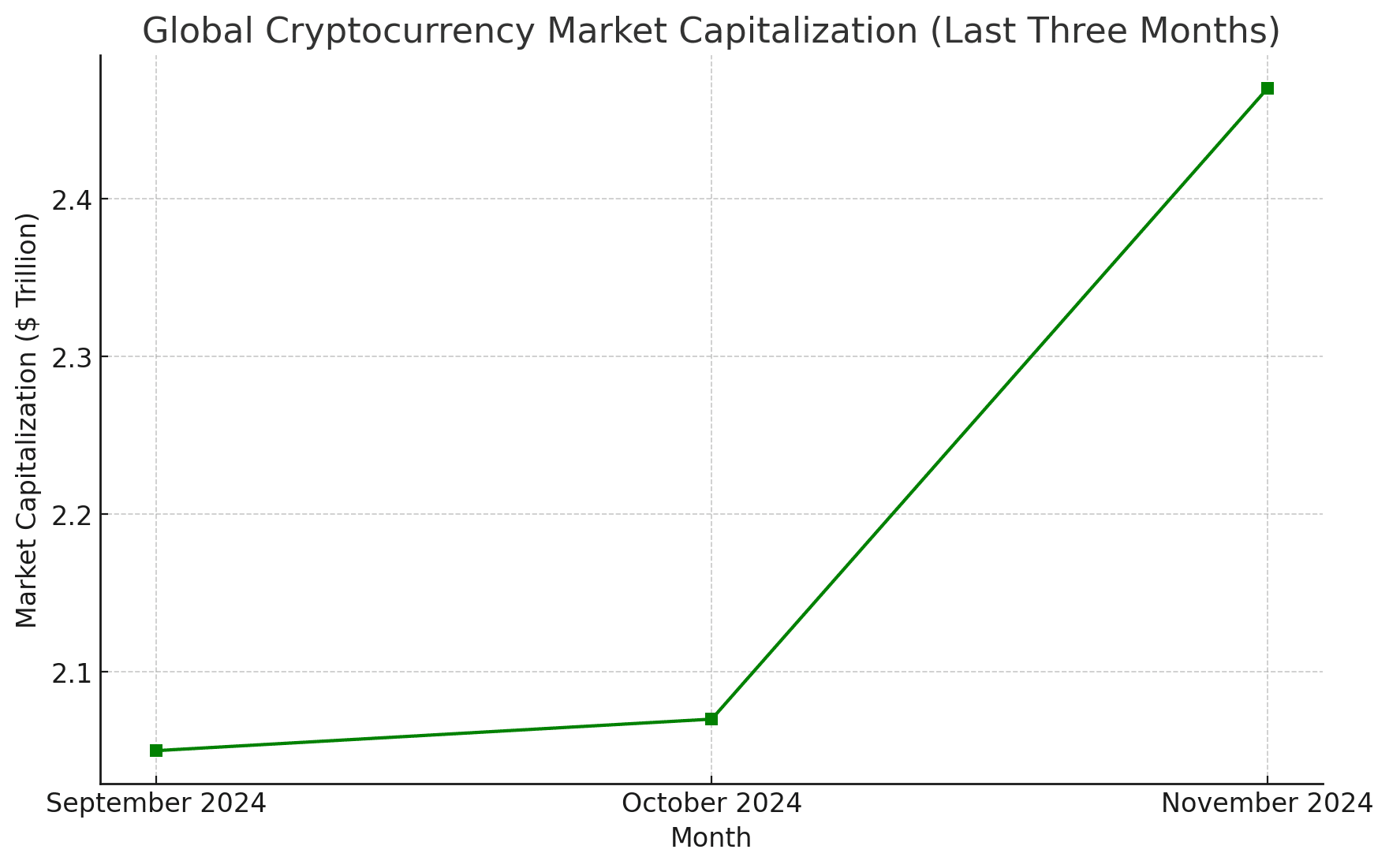

Capitalization of the global cryptocurrency market reached $2.47 trillion on November 6, marking a remarkable 10.75% increase in just 24 hours as optimism surged in response to political developments.

Comparative Analysis with Previous Months

Capitalization has seen substantial fluctuations this year, indicating shifting investor confidence. The table below highlights the market capitalization for the last three months:

Monthly Capitalization Overview

| Month | Market Capitalization ($ Trillion) |

|---|---|

| September | 2.05 |

| October | 2.07 |

| November | 2.47 |

Price movement patterns indicate a strong recovery this month following declines earlier in the year, with significant spikes correlating with notable events, including the ongoing election sentiment.

Key Factors Influencing Market Movements

Factors affecting the current market include various elements that collectively contribute to price changes. Key influencing factors consist of:

- Political developments, particularly regarding the US elections

- Growing institutional and retail interest

- Market sentiment reflected in the Fear & Greed Index

- Technical indicators and trading volumes

Knowing the dynamics around these factors can empower you in your investment strategy.

It’s important to understand how these elements can drive market fluctuations. Factors such as:

- Major news events impacting crypto regulations

- Shifts in trading volume across major exchanges

- Price action following key technical resistance levels

- Investor sentiment influenced by media coverage

Knowing these insights will help you navigate the crypto landscape effectively.

Bitcoin (BTC) Surge Towards All-Time High

You are witnessing a significant moment in cryptocurrency as Bitcoin (BTC) surges close to its all-time high of $75,000. This surge has been fueled by the excitement surrounding the potential outcomes of the U.S. presidential election, particularly the favorable sentiment generated by Donald Trump’s early leads. As of November 6, Bitcoin is trading around $74,843, reflecting a remarkable 9.15% increase within 24 hours.

Historical Price Changes Leading Up to November 6

Towards this critical juncture, Bitcoin has experienced substantial volatility, riding the waves of market responses to political events. In the days leading up to November 6, BTC amassed a series of gains, gradually building momentum as election results began to unfold. Such price increases have positioned Bitcoin on the cusp of breaking its previous all-time high established earlier in the year.

Impact of Donald Trump’s Rally on Market Sentiment

Price fluctuations in Bitcoin significantly correlating with Donald Trump’s rally signify a heightened market sentiment. As Trump’s prospects for winning the election began to rise, traders demonstrated increased buying activity, causing Bitcoin prices to climb rapidly. This trend reflects a broader belief that a Trump presidency could lead to favorable regulations for the cryptocurrency sector.

To further emphasize this trend, the optimism surrounding Trump’s candidacy has effectively mobilized investors, driving substantial short liquidations—over $94 million worth—which contributed to Bitcoin’s sharp increase. The overall enthusiasm for a pro-crypto agenda under Trump’s potential leadership reinforces a bullish market sentiment, influencing not just Bitcoin but other altcoins as well.

Predictions for Bitcoin Prices in the Coming Weeks

By analyzing current trends, many analysts predict that Bitcoin’s bullish momentum may continue, potentially reaching or surpassing the coveted $75,000 mark. The sentiments surrounding the election’s outcome are expected to carry significant weight in shaping market behavior going forward.

Even as excitement builds, it’s vital to remain vigilant, as the market remains reactive to ongoing political developments. Analysts suggest that positive regulatory signals could further elevate Bitcoin prices in the coming weeks, while any shifts in sentiment related to the election could lead to increased volatility. Thus, staying informed will be crucial for making strategic decisions in your investment approach.

Ethereum (ETH) Price Trends

To observe the current trends, Ethereum (ETH) has shown a significant increase today, currently priced at $2,591.99, reflecting a 24-hour gain of 6.84 percent. This positive momentum aligns with the favorable conditions in the broader cryptocurrency market, driven by Bitcoin’s surge as it approaches its all-time high of $75,000. The overall increase in market sentiment has also contributed to the growth of Ethereum’s value, positioning it as a strong asset in your investment portfolio.

Recent Developments in Ethereum 2.0

Recent updates about Ethereum 2.0 indicate ongoing upgrades aimed at improving network scalability and security. These enhancements, including the transition from proof-of-work to proof-of-stake, promise to create a more energy-efficient and sustainable blockchain. As you follow these developments, they could have a positive impact on Ethereum’s long-term adoption and overall market price.

Correlation Between BTC and ETH Prices

With Bitcoin’s current rally, Ethereum has experienced a similar upward trend, showcasing a strong correlation in price movements between the two leading cryptocurrencies. This interdependence is often influenced by broader market sentiments, where gains in Bitcoin typically pave the way for altcoins like Ethereum.

Hence, this relationship hints at a symbiotic market behavior, whereby positive news and price increases for Bitcoin often prompt a surge in Ethereum’s value. You may find that trading patterns exhibit this correlation, making it vital to monitor Bitcoin’s fluctuations to gain insights into potential movements in Ethereum prices.

Future Predictions for Ethereum’s Market Performance

Around the buzz of the upcoming US elections and Bitcoin’s soaring reputation, Ethereum’s future market performance looks promising. Analysts predict that if the bullish sentiment continues, Ethereum could see further gains, especially with an evolving market landscape and institutional interest growing.

Prices for Ethereum may persist in rising as it benefits from Bitcoin’s momentum, along with its own advancements in technology and applications. You should consider keeping an eye on regulatory developments and network upgrades, as they can play a significant role in shaping future trends for Ethereum and its overall position in the market.

Dogecoin (DOGE) Market Analysis

Your analysis of Dogecoin (DOGE) on November 6 shows a notable surge, following the positive sentiment surrounding the US election. DOGE’s price has experienced a significant increase of 31.18%, currently trading at approximately $0.212. This rally is indicative of a broader upward trend in the cryptocurrency market influenced by external events, particularly the resurgence of political excitement and the favorable outlook on crypto policies.

Social Media Influence on Dogecoin Prices

After Donald Trump’s early lead in the election, social media platforms have amplified the enthusiasm for Dogecoin, with tweets and posts driving its popularity and price. The community-driven nature of DOGE often responds to social media trends, leading to rapid price fluctuations based on sentiment expressed online. This interaction showcases how digital platforms can significantly sway the market dynamics for cryptocurrencies like Dogecoin.

Recent Partnerships and Collaborations

The ongoing developments in Dogecoin’s ecosystem have been bolstered by strategic partnerships and collaborations, enhancing its usability and market appeal. These alliances are crucial in establishing Dogecoin as not just a meme-based currency but a serious contender in the cryptocurrency market.

In addition, recent collaborations with businesses accepting Dogecoin for transactions have expanded its utility. Such partnerships not only increase demand but also reinforce credibility, attracting long-term investors who see value beyond its meme status. As institutions explore avenues for digital currency integration, Dogecoin’s visibility and acceptance continue to grow, further supporting its price action.

Analysis of Trading Volume and Patterns

Media coverage and the excitement generated around Dogecoin have led to a noticeable increase in trading volumes. This uptick suggests heightened investor interest and engagement, indicative of shifting market sentiments towards this cryptocurrency.

Analysis of the trading patterns reveals a surge in volume coinciding with key announcements and election updates, highlighting a responsive market. Patterns indicate that as news spreads through various channels, traders are quick to react, thus amplifying price movements. Monitoring these patterns can provide you with insights into potential price trends and market sentiment shifts, enabling better-informed trading decisions.

Litecoin (LTC) Performance Snapshot

Now, Litecoin has demonstrated a significant upward trend amid the recent market rally, currently priced at $70.05, marking a 24-hour gain of 5.33%. This surge aligns well with broader trends in the crypto market, as investors respond positively to the anticipation surrounding the U.S. election results, with Litecoin benefiting from increased market confidence.

Comparison with Bitcoin and Other Altcoins

One crucial aspect of Litecoin’s performance is its comparison to Bitcoin and other altcoins, reflecting its market positioning:

Litecoin vs. Bitcoin and Altcoins

| Litecoin (LTC) Price | $70.05 (5.33% gain) |

| Bitcoin (BTC) Price | $74,843.31 (9.15% gain) |

| Ethereum (ETH) Price | $2,591.99 (6.84% gain) |

| Dogecoin (DOGE) Price | $0.2082 (29.43% gain) |

Recent Technological Developments

Along with the market fluctuations, recent technological advancements have also played a pivotal role in Litecoin’s performance. These developments enhance security and transaction efficiency, ensuring that Litecoin remains a viable option for users and investors alike.

Technological upgrades, including the implementation of the Mimblewimble protocol, significantly improve privacy and scalability features. This innovation not only boosts transaction speeds but also enhances the appeal of Litecoin as a practical alternative for everyday use, contributing positively to its value in the marketplace.

Market Demand and Supply Dynamics

Technological evolution is intertwined with the market demand and supply dynamics that influence Litecoin’s current pricing. As you explore the cryptocurrency landscape, understanding these factors becomes crucial to gauge future trends effectively.

Supply considerations, such as the fixed maximum of 84 million LTC, can create scarcity in a growing market. Combined with increasing demand, especially as Litecoin incorporates new technological features, the balance of supply and demand significantly impacts the price and overall market sentiment, leading to potential investments in this cryptocurrency.

Ripple (XRP) and its Competitive Edge

All eyes are on Ripple (XRP) as it continues to carve its niche in the competitive cryptocurrency landscape. Unlike many other cryptocurrencies, Ripple focuses on facilitating secure and low-cost cross-border transactions, which gives it a unique edge in the financial sector. As your interest in cryptocurrencies grows, understanding Ripple’s advancements and its current standing can benefit your investment strategy, especially as its partnerships position it favorably against competitors.

Ripple’s Legal Battle and Market Impact

By facing ongoing litigation with the SEC, Ripple has not only showcased its resilience but also its potential market adaptability. The outcome of this legal battle has been pivotal for investors and may dictate Ripple’s regulatory landscape, impacting its market performance. You should keep a close eye on these developments, as they could significantly influence XRP’s price trajectory in the near future.

Recent Partnerships with Financial Institutions

One of Ripple’s strengths lies in its strategic partnerships with established financial institutions worldwide. These collaborations enhance its credibility and broaden its operational reach. By integrating XRP into their payment solutions, these institutions enable faster, more efficient cross-border transactions which may drive demand for XRP, presenting opportunities for you as an investor.

Battle-tested through regulatory challenges, Ripple has secured partnerships with notable institutions like Santander and American Express. These alliances not only validate Ripple’s technology but also signal growing institutional adoption of digital currencies. As these financial entities increasingly utilize XRP for real-time settlement, you may find that Ripple’s commitment to innovation can lead to promising long-term growth in your investment considerations.

Ripple’s Position in the Market Moving Forward

Between regulatory clarity and expanding partnerships, Ripple’s positioning within the cryptocurrency market looks optimistic. As a potential investor, you might note that continued collaboration with global banks can reinforce XRP’s usability and acceptance, impacting the asset’s future value positively.

With its strong focus on enhancing payment systems and maintaining compliance, Ripple is likely to benefit from a favorable regulatory environment, setting the stage for future growth. Should partnerships with financial institutions increase, you may see XRP gaining traction as a preferred digital asset, potentially elevating your investment portfolio in the ever-evolving crypto market.

Solana (SOL) Price Performance

After a strong showing in recent days, Solana (SOL) exhibited impressive price movements, standing at $186.57 with a remarkable 16.54% gain in the last 24 hours. This surge reflects the overall positive sentiment surrounding the cryptocurrency market, driven largely by external factors, including the U.S. election results and Bitcoin’s record-breaking performance.

Rise and Fluctuation of Solana’s Value

After witnessing steady growth, Solana’s value has fluctuated significantly as it adapts to market dynamics. The recent uptick, coupled with a robust performance relative to other altcoins, underscores a renewed interest among investors, contributing to its substantial rise.

Recent Innovations in Solana’s Ecosystem

Performance enhancements within Solana’s ecosystem have been pivotal in attracting investor attention and driving its value higher. The platform has introduced various upgrades, optimizing transaction speeds and lowering fees, making it an increasingly attractive option for developers and users alike.

Due to these innovations, Solana has established itself as a competitive force in the decentralized finance (DeFi) and non-fungible token (NFT) spaces. The ability to handle high transaction volumes with lower costs has not only enhanced user experience but also sparked interest from large institutional investors, further bolstering its market position.

Investor Sentiment Towards Solana

About your investment approach, it’s necessary to recognize the growing enthusiasm among investors regarding Solana. The current market conditions, alongside its technological advancements, have cultivated a positive perception that you may want to consider in your overall investment strategy.

Fluctuation in sentiment has been driven by Solana’s consistent updates and the supportive impact of a broader bullish market. As traders and investors observe its upward trajectory, confidence in its long-term viability as a key player in the crypto landscape continues to strengthen, encouraging more people to explore investment opportunities within its ecosystem.

Top Crypto Gainers of November 6

Despite recent market fluctuations, November 6 marked a significant day for cryptocurrency, with numerous assets experiencing remarkable gains. Leading the pack was Goatseus Maximus (GOAT), which surged over 51.5%. Dogecoin (DOGE) also made waves, climbing 31.18%, while other notable gainers included dogwifhat (WIF) and Bonk (BONK), reflecting a vibrant sentiment in the market.

Analysis of the Leading Gainers

By observing the trends among today’s top gainers, it’s evident that the cryptocurrency market thrives on investor sentiment. The surge in popularity for GOAT and DOGE showcases the community-driven nature of altcoins, driving significant price actions fueled by online discussions and social media buzz.

Factors Contributing to their Growth

To understand the growth of these cryptocurrencies, consider the following elements:

- Increased investor confidence linked to recent political events

- Strong community support and social media engagement

- Market speculation positioning these assets as alternatives

This rise is not only a result of the election dynamics but also reflects growing community engagement and interest in innovative blockchain projects.

Future Outlook for Top Performers

Growth potential for these top performers remains optimistic, as the cryptocurrency landscape continues evolving. With major political events influencing market sentiment, your investment strategies may benefit from focusing on assets like DOGE and GOAT.

Performers like GOAT are likely to keep gaining traction, especially if community support reinforces their market positions. Keep an eye on trends and maintain an adaptable approach to capitalize on emerging opportunities, as dynamics within the crypto space can shift rapidly, driven by both news and market sentiment.

Top Crypto Losers of November 6

Once again, the cryptocurrency market showed volatility with several altcoins witnessing declines on November 6. Monero (XMR) retained its position as the biggest loser, recording a slight 0.36 percent drop, while Tron (TRX) and UNUS SED LEO (LEO) also faced minimal losses of 0.06 percent and 0.01 percent, respectively. Despite the overall bullish sentiment surrounding Bitcoin’s rally, some digital assets could not sustain upward momentum, reflecting a divided market landscape.

Overview of Cryptocurrency Declines

Before delving into the specifics, it’s vital to note the mixed market reaction amidst Bitcoin’s surge towards its all-time high of $75,000. While many cryptocurrencies enjoyed gains, a few experienced downward pressure, highlighting an underlying volatility in the market despite the overall bullish trend. Understanding these declines is equally important for navigating your investment strategies.

Reasons Behind the Drop in Prices

By examining the factors contributing to the declines, you can better understand market dynamics. Subdued trading volume and profit-taking behaviors among investors looking to secure gains from the recent rally are significant contributors to the downward adjustments seen in prices.

Drop in market sentiment often leads to price corrections, particularly after significant rallies. As Bitcoin approached its all-time high, some investors opted to cash out, leading to temporary declines in various altcoins. Additionally, market speculation and fears of a post-election correction may have contributed to cautious trading behavior, impacting overall confidence.

Opportunities for Investors Amid Losses

Across the fluctuating landscape, lower prices can present unique opportunities for savvy investors. The recent declines in certain cryptocurrencies can allow you to acquire assets at a more favorable entry point, especially if you believe in their long-term potential.

Consequently, this market dynamic encourages you to evaluate your investment portfolio critically. By assessing the fundamentals of coins that have dipped, you can strategically position yourself to benefit from future recoveries. Engaging in dollar-cost averaging while prices are low can enhance your overall investment strategy in this volatile market.

Market Sentiment and Investor Behavior

Notably, the current market sentiment around cryptocurrencies is heavily influenced by the unfolding political landscape. As Donald Trump gains traction in his potential presidential campaign, investors exhibit increased optimism, which is reflected in rising crypto prices. The overall Market Fear & Greed Index currently stands at 54, indicating a neutral sentiment, yet the buzz surrounding the election has reignited investor enthusiasm, suggesting a shift towards a more risk-on approach.

Here are the charts illustrating Bitcoin’s price trends, trading volume during key events, and market capitalization trends over the past three months:

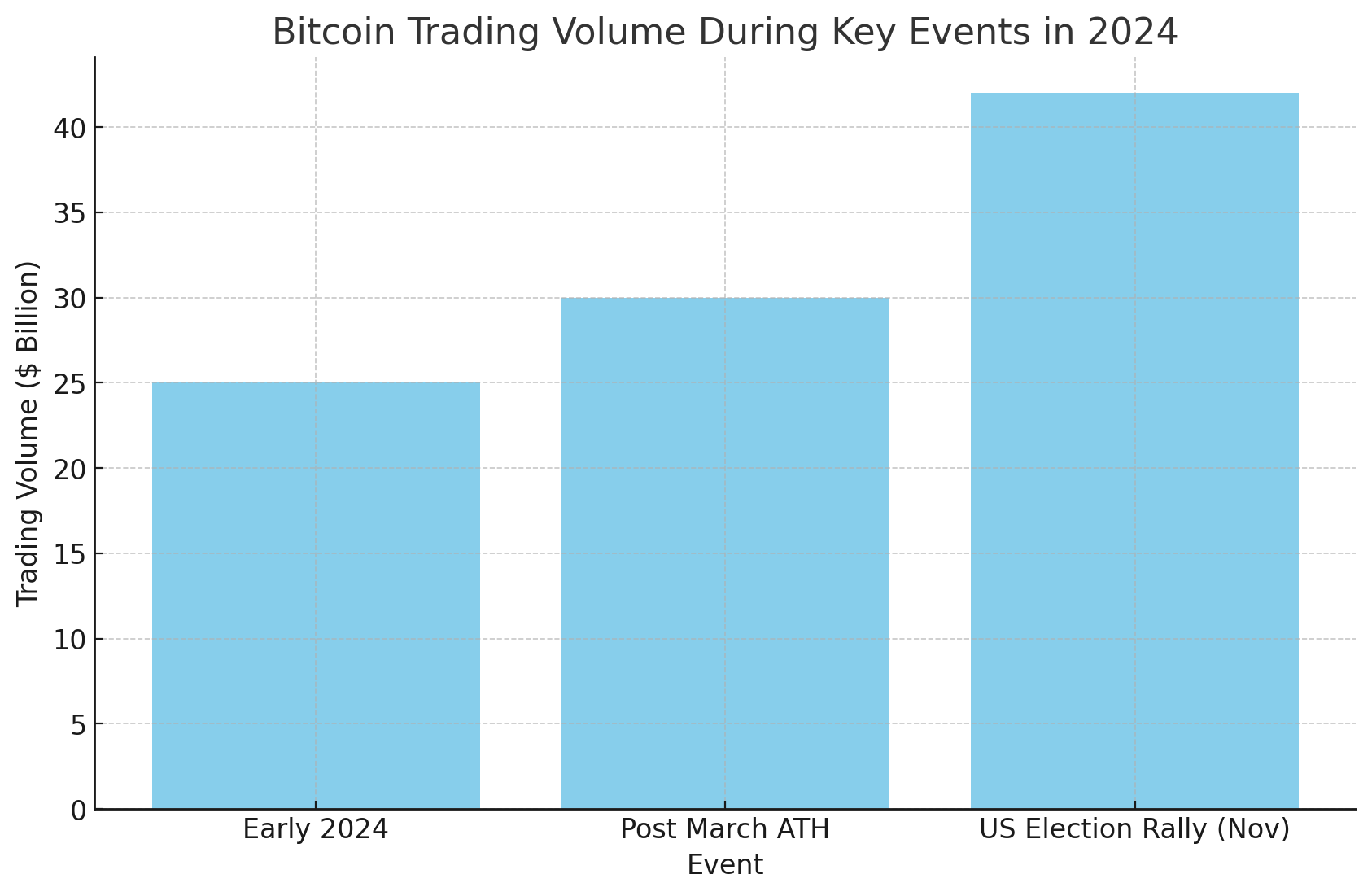

Bitcoin Trading Volume During Key Events In 2024

Here are the charts illustrating Bitcoin’s price trends, trading volume during key events, and market capitalization trends over the past three months:

-

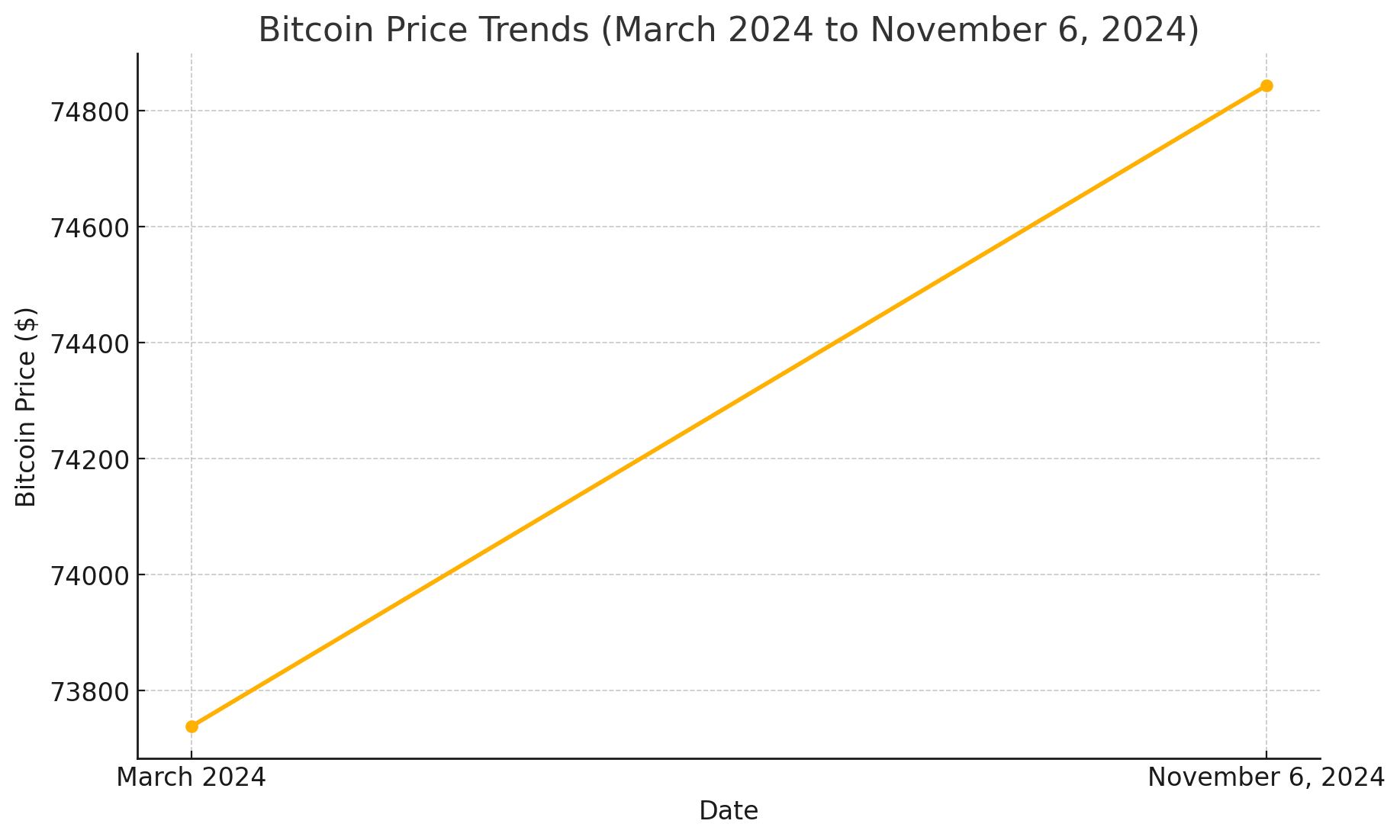

Bitcoin Price Trends (March 2024 to November 6, 2024): This line chart shows Bitcoin’s journey from its previous all-time high in March 2024 ($73,737.94) to its current level near $74,843.31 on November 6, 2024.

-

Bitcoin Trading Volume During Key Events in 2024: This bar chart highlights trading volume surges during significant events, including early 2024, post-March ATH, and the recent US election rally in November, reaching approximately $42 billion.

-

Global Cryptocurrency Market Capitalization (Last Three Months): The line chart illustrates the market cap growth from September ($2.05 trillion) to November 2024 ($2.47 trillion), reflecting the increasing market interest and sentiment.

Influences of News and Events on Price Movements

At the forefront of market movements, significant news events such as political elections can cause abrupt price changes. Recent election results showing Trump’s lead have triggered a remarkable rally in Bitcoin, pushing it closer to its all-time high. With Bitcoin trading at approximately $74,843, favorable news has fueled trader sentiment and market activity, contributing to a 24-hour gain of over 9.15 percent.

Behavioral Analysis: Fear and Greed Index

To understand market dynamics, a close examination of the Fear and Greed Index is valuable. Currently sitting at 54, it reflects a neutral stance among crypto investors. This index assists in gauging the prevailing emotions in the market, helping you to make informed decisions based on actual investor behavior rather than market speculation.

But it’s necessary to note that while the index indicates neutrality, a rise in investor interest can shift market sentiment quickly. As excitement around potential political outcomes grows, you might see a transition from fear to greed, prompting more aggressive trading and investment strategies as the market reacts to unfolding events.

Retail vs. Institutional Investor Trends

About the current landscape, retail and institutional investors are navigating the market with distinct approaches. While retail investors react quickly to news and social media trends, institutional players tend to make strategic moves influenced by broader economic indicators and long-term forecasts. This dichotomy can result in divergent price movements, highlighting the complexities of today’s cryptocurrency market.

Market analysis shows that both retail and institutional investors are increasingly participating in the cryptocurrency space, with institutional investment driving significant capital into Bitcoin and other digital assets. You may find that as institutional interest ramps up, the stability and credibility of cryptocurrencies expand, potentially leading to more sustainable price increases over time.

Expert Opinions and Predictions

Keep a close eye on the evolving cryptocurrency landscape while experts weigh in on Bitcoin’s impressive surge. With Donald Trump’s election rally driving market sentiments, analysts anticipate that the momentum could push Bitcoin beyond the all-time high of $75,000. Experts emphasize that upcoming election results and regulatory talks will be key in shaping future price movements.

Insights from Leading Analysts

Analysts are optimistic regarding Bitcoin’s potential, considering its recent rise has been fueled by significant institutional investments and a favorable political environment. They highlight that Bitcoin’s rejection of previous bearish patterns demonstrates its resilience and increasing demand among both retail and institutional investors.

Technical Analysis Overview

About the technical indicators, Bitcoin is facing resistance around the $75,000 mark, while support levels remain at approximately $67,700. This suggests a critical phase where holding above these levels could trigger further buying interest in the market. Analysts observe that the recent price action indicates bullish trends, aligning with historical patterns seen during pivotal political events.

Indeed, recent data shows Bitcoin trading around $74,843, reflecting a gain of 9.15% in just 24 hours. This aligns with previous patterns where markets have seen substantial upward movements during election cycles. You should consider these insights when evaluating entry points in the crypto market, as overcoming resistance could signal a sustained rally.

Long-Term vs. Short-Term Predictions

Analysts suggest that while short-term volatility is expected due to political developments, long-term projections for Bitcoin remain bullish. They argue that if Bitcoin maintains current levels, it may lead to a broader rally across altcoins, with increased investor interest driving prices higher over time.

Technical indicators support the notion of sustained growth, especially given that Bitcoin’s historical performance during election cycles has often led to longer-term appreciation. Traders should weigh both short-term fluctuations and long-term potential as they make strategic decisions in the current market climate.

Regulatory Developments Impacting the Crypto Market

Many factors contribute to the fluctuations in the cryptocurrency market, but regulatory developments have consistently played a significant role in shaping investor confidence and market performance. As Bitcoin approaches its all-time high of $75,000 amidst the current election excitement, understanding the regulatory landscape becomes imperative for you as an investor.

Overview of Recent Regulations

With ongoing discussions about cryptocurrency regulations gaining momentum worldwide, various governments are working to establish clearer frameworks. In the U.S., the Biden administration has initiated dialogues to ensure compliance and foster innovation in the crypto space, which could lead to newfound stability and growth.

Effects on Bitcoin and Other Cryptos

An increasing number of regulations can lead to both opportunities and challenges for Bitcoin and other cryptocurrencies. As more institutional investment flows into crypto, particularly if regulations favor the industry, you may witness heightened bullish sentiment that could drive prices further up.

Due to the positive regulatory outlook, Bitcoin and other altcoins have positioned themselves for significant gains. Reports indicate that Bitcoin’s rise, attributed to favorable election sentiments and supportive regulations, creates an environment where institutional and retail investors are optimistic. This surge is further reflected in the fear and greed index, suggesting that the growing confidence will likely continue to push prices upward.

Future Regulatory Trends

Bitcoin regulations are expected to evolve, with a focus on creating a balanced approach that protects consumers while encouraging innovation. Understanding these trends will be vital as you navigate your investment strategies in the cryptocurrency realm.

Hence, the future regulatory landscape may foster an environment of increased legitimacy for cryptocurrencies. As regulatory clarity emerges, more investors, including institutions, are likely to enter the market, potentially propelling Bitcoin and altcoins to new heights. Staying informed about these trends can help you make informed decisions in this dynamic space.

The Role of Crypto Exchanges in the Current Market

Unlike traditional financial markets, cryptocurrency exchanges have played a vital role in facilitating real-time trading and enabling investors to capitalize on market movements. As Bitcoin surged toward its all-time high of $75,000, these platforms became critical access points for traders looking to buy or sell digital assets. With increased trading volumes and volatility, the efficiency and responsiveness of these exchanges have taken center stage in supporting the current market rally.

Popular Exchanges and Trading Volumes

Beside the price surges seen in major cryptocurrencies like Bitcoin and Ethereum, popular exchanges have reported significant increases in trading volumes. Despite recent fluctuations, platforms such as Binance, Coinbase, and Unocoin have witnessed heightened activity, with traders engaging in both buying and selling amid political developments driving cryptocurrency sentiment. These dynamics illustrate the importance of liquidity in capturing opportunities as market conditions shift.

Security Features and User Trust

Beside the importance of trading volume, security features on exchanges are paramount to maintain user trust. With the rise in crypto investments, platforms are implementing advanced security measures like two-factor authentication, cold storage wallets, and regular security audits to safeguard transactions. This focus on security reassures traders and potentially attracts new investors who prioritize protecting their assets in a rapidly evolving market.

Another key aspect of user trust is the transparent communication from exchanges regarding their security protocols. As you navigate the cryptocurrency landscape, understanding how your chosen platform secures your investment is vital. Many exchanges now provide user education on safety practices, such as recognizing phishing attempts and securely managing wallets, further enhancing the overall trustworthiness of these platforms.

Innovations in Exchange Technologies

For crypto exchanges, continuous innovations in technology are transforming the user experience and offering enhanced functionalities. Features like decentralized exchanges (DEXs), automated market makers (AMMs), and smart contract integrations improve trading efficiency and expand access to a broader audience. These advancements empower you to engage more dynamically with your investments while taking advantage of newly emerging market trends.

Volumes of trading and liquidity pools have surged as a result of these technological innovations. You may find that as exchanges adapt to new technologies, you gain access to features that not only streamline your trading experience but also provide tools for deeper analysis and strategy development. These enhancements ultimately contribute to making trading more accessible and informed for you as an investor in the crypto ecosystem.

Conclusion

Taking this into account, the significant rise in cryptocurrency prices, particularly Bitcoin nearing its all-time high, reflects how external political events, such as Donald Trump’s rally, can influence market sentiment and investor behavior. As you navigate this volatile landscape, staying informed about such developments can help you make more strategic investment decisions. With ongoing enthusiasm in the market, your awareness of the broader economic and political context will be crucial in assessing future opportunities and risks in the cryptocurrency space.

Disclaimer by Dawkco News

The information provided in this article is for informational purposes only and does not constitute financial advice. Dawkco News and the author, Sanjay Gupta, do not endorse any cryptocurrency or investment platform mentioned herein. Readers are encouraged to conduct their own research and seek professional financial advice before making any investment decisions. Cryptocurrency markets are highly volatile, and investments involve significant risk. Neither Dawkco News nor Sanjay Gupta shall be held liable for any financial losses or damages resulting from reliance on the information provided in this article.