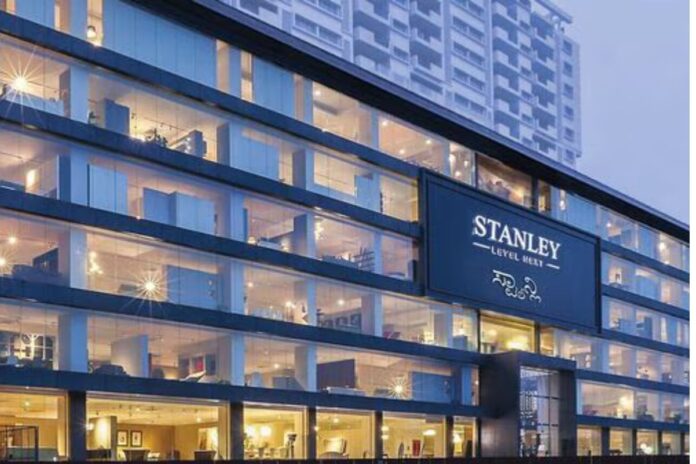

Stanley Lifestyles, renowned for its premium and luxury furniture, has launched its Initial Public Offering (IPO) today, making waves in the market. Here are the key details to consider:

IPO Details:

- Price Band: The IPO is priced between ₹351 and ₹369 per share.

- Total Issue Size: The company aims to raise ₹537.02 crores, including a fresh issue of ₹200 crores and an offer for sale of ₹337.02 crores.

- Lot Size: Investors can bid for a minimum of 40 shares, which translates to an initial investment of ₹14,760.

- Reservation: The IPO allocates 50% for Qualified Institutional Buyers (QIB), 15% for Non-Institutional Investors (NII), and 35% for Retail Investors.

- Key Dates: The IPO is open from June 21, 2024, to June 25, 2024. Allotment will be finalized by June 26, with shares credited to demat accounts by June 27. The listing date is set for June 28, 2024.

- The Initial Public Offering for Stanley Lifestyles includes a new issuance valued at ₹200 crore, along with a sale offer of 9,133,454 equity shares from existing promoters and shareholders.

- During this sale, co-founders Sunil Suresh and Shubha Sunil are set to divest up to 1,182,000 shares each. Additional sellers include Oman India Joint Investment Fund II, which will sell 5,544,454 shares, Kiran Bhanu Vuppalapat who is offering 1,000,000 shares, and Sridevi Venkata Vuppalapati, who will sell 225,000 shares.

Grey Market Premium (GMP):

The Grey Market Premium (GMP) for Stanley Lifestyles IPO is currently around ₹111, indicating a strong market sentiment and potential listing gains.

Financial Performance:

- FY2021: Total revenue stood at ₹201.71 crores with a net profit of ₹1.92 crores.

- FY2022: Revenue increased to ₹297.75 crores, and net profit rose to ₹23.21 crores.

- FY2023: Revenue further grew to ₹425.62 crores with a net profit of ₹34.97 crores.

Competitive Strengths:

- Stanley Lifestyles is the largest and fastest-growing brand in the luxury and super-premium furniture segment in India.

- It operates with a vertically integrated manufacturing process, ensuring high quality and innovative design.

- The company has a robust presence across major metropolitan areas with a mix of company-owned and franchise stores.

- It is backed by an experienced management team and a solid track record of financial performance.

Investment Rationale:

Investing in Stanley Lifestyles IPO presents an opportunity to participate in a leading luxury furniture brand’s growth. The company’s consistent financial performance, extensive market presence, and innovative product offerings make it an attractive proposition. Additionally, the positive grey market sentiment suggests potential listing gains.

However, potential investors should consider the risks, including market competition and economic fluctuations, before making an investment decision. It is essential to evaluate personal risk tolerance and investment goals.

Stanley IPO Subscription Update

As of today at 12:54 IST, the Stanley Lifestyles IPO has achieved a 59% subscription rate, according to data from the BSE.

The offering has attracted offers for 60,09,600 shares, which compares to the total availability of 1,02,41,507 shares, also reported by the BSE.

Subscription rates among different investor classes vary, with non-institutional investors participating at a rate of 72% and Retail Individual Investors at 85%. Meanwhile, bids from Qualified Institutional Buyers (QIBs) are still pending to be booked.

Stanley Lifestyles IPO Review

Anand Rathi Research

The projections from the brokerage indicate that in the financial year 2023, they rank as the fourth largest company in terms of revenue within the Indian home furnishings sector. From a valuation standpoint, the company appears highly valued, trading at a price-to-earnings ratio of 60 times following the issuance of additional equity shares, based on FY23 earnings, and lacks any direct competitors in the public market.

The brokerage opines that the company is poised for operational enhancements, driven by favorable industry trends, strong brand recognition, and the potential for further scaling of operations. Consequently, they offer a “SUBSCRIBE – long term” endorsement for the Initial Public Offering (IPO).

Indsec Securities

The investment firm reports that at a peak pricing of ₹369 per share, the IPO values at 79.8 times the forecasted earnings for FY24. The company, Stanley Lifestyles, which produces and sells high-end home furnishings, lacks a direct competitor for comparison. From FY21 to FY23, its revenue grew at a compound annual growth rate (CAGR) of46.3%, thanks to the expansion of retail outlets and an uptick in sales. During the same period, both EBITDA and PAT saw a significant rise at a CAGR of 67% and 465% respectively, albeit from a smaller base. The management expects a 20-25% sales growth over the next two to three years, with a prioritization on enhancing profitability.

For fiscal year 2024, the projected return on equity (ROE) and return on capital employed (ROCE) are anticipated to be 11% and 16.8% respectively. The net funds raised will be allocated towards expansion and refurbishment of stores, as well as capital investments in equipment. The brokerage believes that growth could be catalyzed by several factors including robust demand in the real estate sector, the opening of new stores, and more local sourcing of materials like leather and wood to streamline production costs. Hence, they recommend subscribing to the stock.

Disclaimer: The opinions and suggestions presented above are solely those of the contributing analysts or brokerage firms, rather than those of Dawkco News. We recommend that investors consult with qualified professionals before taking any investment actions.